Published by Sherry Cooper

May employment growth in Canada stalled as the unemployment rate ticked up to 6.2%.

May Jobs Report

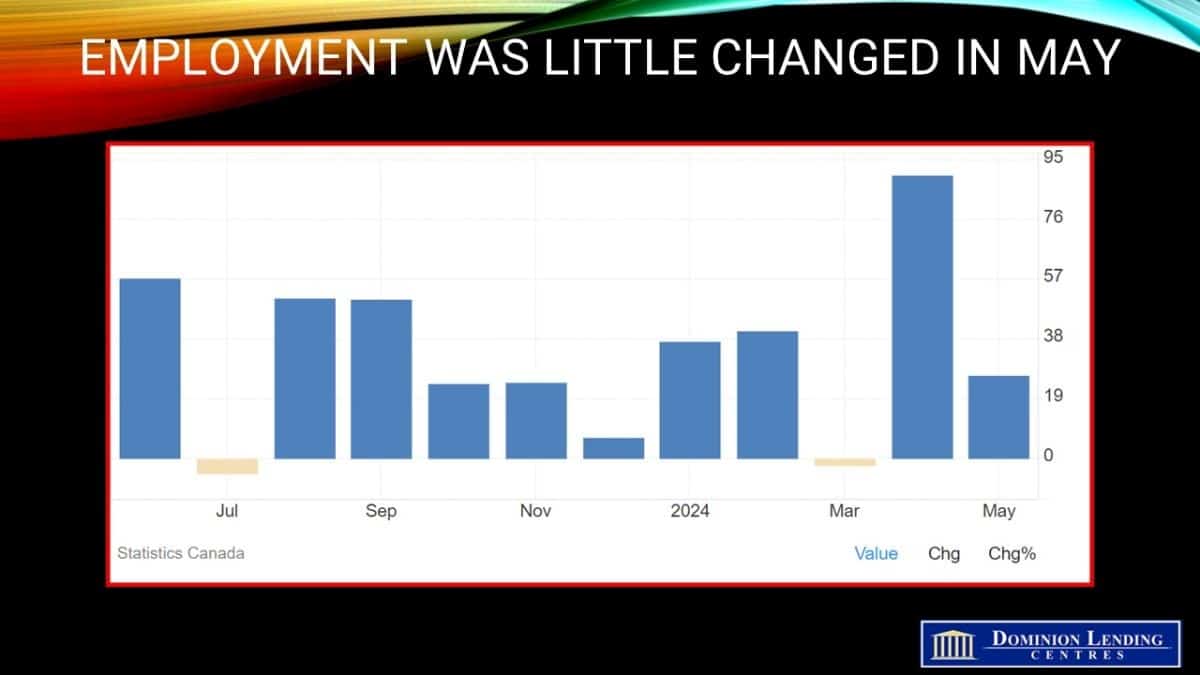

In the first major data release since the Bank of Canada cut interest rates on Wednesday, Statistics Canada Labour Force Survey for May showed a marked slowdown from the April surge. Employment was little changed and the employment rate fell 0.1 percentage points to 61.3%, the seventh decrease in the past eight months.

The number of employed people increased by 27,000 following a gain of 90,000 in April. Year-over-year (y/y), employment rose 2.0% in May. Part-time employment rose by 62,000 (+1.7%) in May, while full-time employment edged down (-36,000; -0.2%). Job creation rose the most in health care and social assistance, followed closely by gains in finance, insurance, real estate, rental and leasing. It fell the most in construction, largely reflecting labour shortages in that sector. Employment gains were reported in only three provinces in May, led by Ontario, Manitoba and Saskatchewan.

Population growth isn’t likely to slow near-term, which means that anything short of about a 45k employment gain will push the jobless rate higher. The jobless rate rose to 6.2%, 1.4 percentage points above the July 2022 cycle low, and the highest level since 2017 (excluding the pandemic).

Total hours worked were unchanged in May and were up 1.6% compared with 12 months earlier.

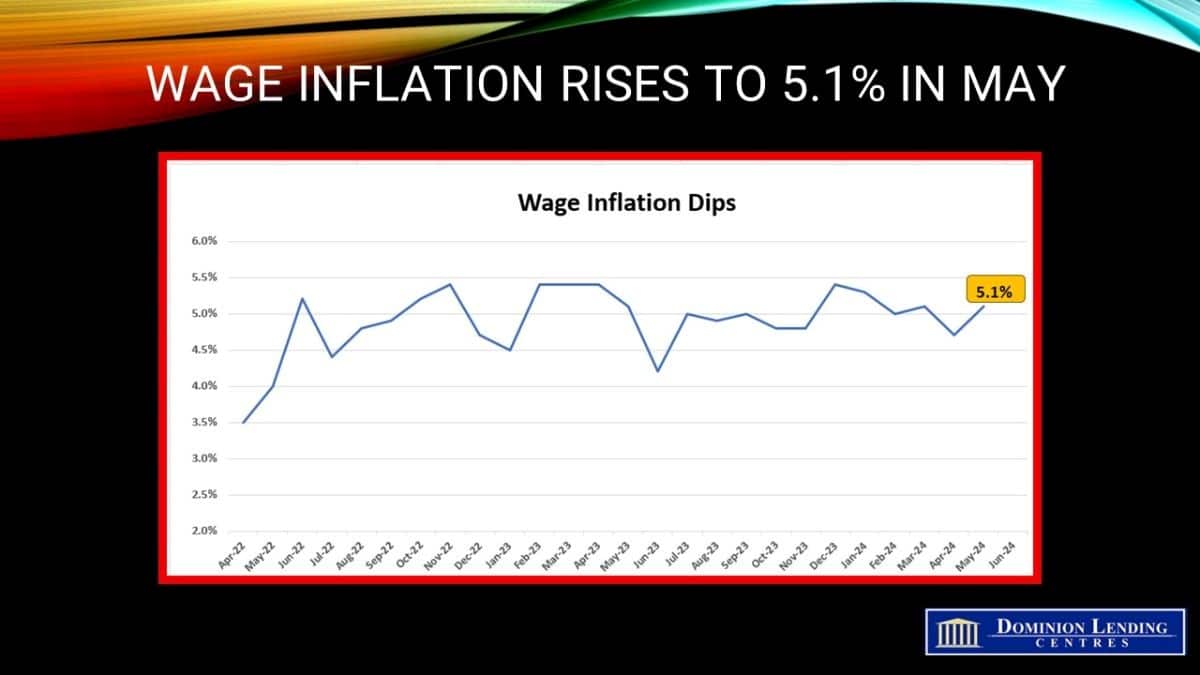

Average hourly wages among employees increased 5.1% year over year in May, following growth of 4.7% in April (not seasonally adjusted). This isn’t going to make the Bank of Canada happy, but there will be another Labour Force Survey release before the next BoC decision date on July 24.

Bottom Line

This report did not contain anything that would forestall another rate cut at the next meeting, with the possible exception of the rebound in wage inflation. This could well reverse with the June data.

CPI will be the key data release in the coming weeks–reported for May on June 25 and June on July 16. We believe the overnight policy rate will trend toward 2.%-to-3.0% from today’s 4.75% by the end of next year.