Published by Sherry Cooper

Bank of Canada Cuts Overnight Rate 25 bps to 4.75%.

A Collective Sigh of Relief As The BoC Cut Rates For the First Time In 27 Month

Today, the Bank of Canada boosted consumer and business confidence by cutting the overnight rate by 25 bps to 4.75% and pledged to continue reducing the size of its balance sheet. The news came on the heels of weaker-than-expected GDP growth in the final quarter of last year and Q1 of this year, accompanied by CPI inflation easing further in April to 2.7%. “The Bank’s preferred measures of core inflation also slowed, and three-month measures suggest continued downward momentum. Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average.”

With continued evidence that underlying inflation is easing, the Governing Council agreed that monetary policy no longer needs to be as restrictive. Recent data has increased our confidence that inflation will continue to move towards the 2% target. Nonetheless, risks to the inflation outlook remain. “Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

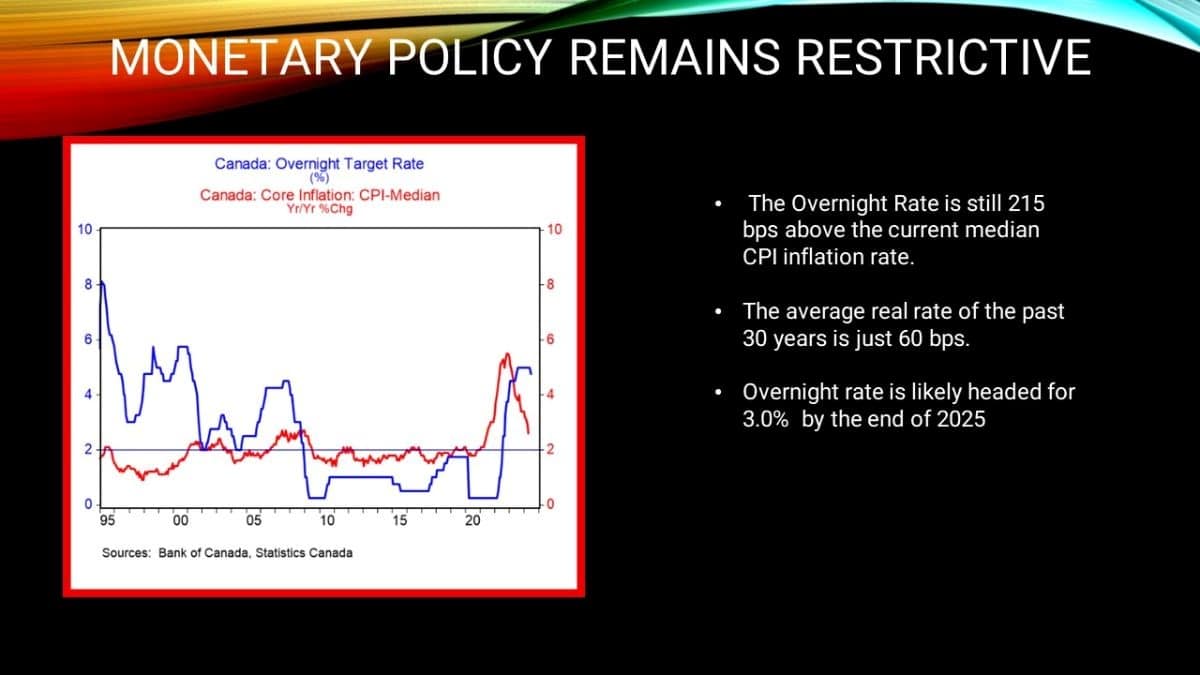

As shown in the second chart below, the nominal overnight rate remains 215 basis points above the current median CPI inflation rate, which shows how restrictive monetary policy remains. The average of this measure of real (inflation-adjusted) interest rates in the past 30 years is just 60 bps. The overnight rate is headed for 3.0% by the end of next year.

Bottom Line

There are four more policy decision meetings before the end of this year. It wouldn’t surprise me to see at least three more quarter-point rate cuts this year. While the overnight rate is likely headed for 3.0%, it will remain well above the pre-COVID overnight rate of 1.75% as inflation trends towards 2%+ rather than the sub-2% average in the decade before COVID-19.